U.S. Bureau of Labour Statistics states that those professionals who work in financial and business occupations earn median wages of more than 80,000 dollars as compared to the median wage across all job markets, averaging nearly 50,000. That’s one of the reasons why finance career jobs are consistently ranked as top career choices in terms of compensation, stability, and career growth.

However, this sector too is undergoing many transformations due to the rise in fintech, dominance of data analytics, and the ever-changing nature of investing. In this article, we’ll go into more detail about finance careers, popular options in the field, and how to find finance jobs. So let’s get straight into it.

An Overview of the Finance Industry

From 2023 to 2033, the average growth rate in all careers is estimated to be about 4.2%. However, this growth rate is much higher for finance-related jobs, estimated at 7% growth rates. The finance professional jobs, though demanding, often offer huge paychecks. Six-figure paychecks are more common than in any industry. The average salaries start from $78,000 all the way up, depending on your roles and skills.

Different financial career sectors require different qualifications, such as the role of a quantitative analyst may require someone with an education background in a Master’s or PHD.

Before you find finance jobs, here is a list of education requirements for different financial career paths:

- Portfolio Manager – Bachelor’s + CFA preferred

- Personal Financial Advisor Jobs – Bachelor’s + CFP preferred

- Labour Relations Specialist – Bachelor’s degree

- Insurance Underwriter – Bachelor’s degree

- Financial Examiner – Bachelor’s degree

- Financial Analyst – Financial adviser

- Budget Analyst – Bachelor’s degree

- Actuary – Bachelor’s + Actuarial exams

8 Popular Finance Careers Description

Here is a detailed list of 8 popular finance careers and what you should know about these careers:

1. Financial Manager

Financial managers oversee a company’s financial health and help companies make informed decisions.

- Developing strategies

- Monitoring cash flow

- Preparing financial reports

- Making sure of regulatory compliance

Financial managers also help guide budgeting and investment decisions to support long-term business growth and profitability.

2. Investment Banker

Investment bankers help the following sectors:

- Corporations

- Governments

- Institutions

They help them raise capital and execute complex financial transactions like mergers and acquisitions. Investment bankers are also responsible for:

- Analyzing market trends

- Assessing risks

- Providing strategic financial advice to clients

3. Actuary

Actuaries analyze financial risks. They make use of subjects like mathematics, statistics, and financial theory. They often work in the following sectors:

- Insurance

- Pensions

- Risk management

An actuary helps companies design policies and make informed decisions based on risk probability and long-term forecasting.

4. Portfolio Manager

Portfolio managers make investment decisions for individuals or institutions. Here is what they do:

- They select assets to meet financial goals.

- Portfolio managers analyse market trends

- They manage risk

- They continuously monitor portfolio performance to optimize returns

5. Quantitative Analyst

These professionals are also known as “quants”. Quantitative analysts use advanced mathematical models and algorithms to analyze financial data, identify trading opportunities, and develop risk management strategies. They’re very important in hedge funds and investment banks.

6. Trader

Traders buy and sell financial instruments such as:

- Stocks

- Bonds

- Commodities

Traders aim to profit from market movements. They work in fast-paced environments and often use technical analysis and real-time data to make quick decisions.

7. Financial Planner

Financial Planners help people manage their finances. They create tailored plans for:

- Budgeting

- Saving

- Investing

- Retirement

- Tax filing

They assess a client’s financial situation and offer strategic advice for future goals.

8. Financial Analyst

Financial analysts evaluate financial data to help businesses and investors make decisions. They assess:

- Economic trends

- Forecast revenues

- Expenses

- Analyze company performance

Financial analysts support budgeting and investment strategies.

How to Find and Enter the Finance Industry

There are many working opportunities in the finance industry for both experienced and inexperienced people. Here are the things that’ll help you to find finance jobs in your finance job search:

1. Preparing Educational Background

The first step is to earn a relevant degree in finance, economics, accounting, or business administration. Courses in statistics, financial modelling, and investment analysis are especially useful and help you move one step forward. If you pursue certifications like CFA, CPA, or FRM, it can further strengthen your qualifications and help you find finance jobs by showing a commitment to the field.

2. Gaining Internships and Work Experience

Internships provide you with hands-on exposure to financial operations and help you develop essential skills. You should seek roles in banks, investment firms, or corporate finance departments. If you find finance jobs at entry-level positions like financial analyst or assistant positions are stepping stones to more advanced roles.

3. Building Networks and Utilizing Industry Resources

It’s a smart idea to attend finance career fairs, seminars, and alumni events to connect with professionals. Use platforms like LinkedIn to follow finance leaders and join relevant groups. Associations like the CFA Institute or local finance clubs offer valuable insights and opportunities.

4. Keeping Up with Industry Trends and Skill Development

You should stay updated with global financial news, market trends, and regulatory changes through resources like Bloomberg, WSJ, or Financial Times. Sharpen analytical, Excel, and communication skills, and consider ongoing learning through courses in data analytics, AI in finance, or fintech.

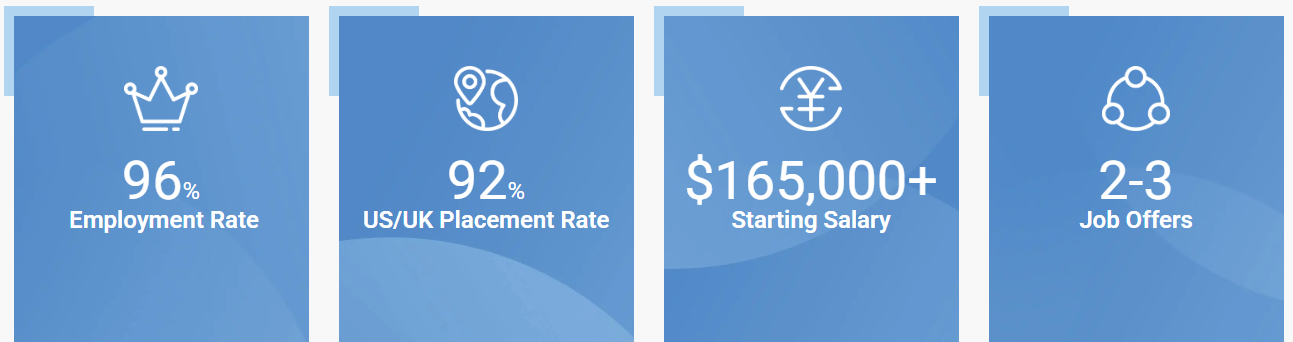

One Strategy Group (OSG)

If your aims are high and you want to find finance jobs in competitive financial industries like finance, consulting, or tech, know that each comes with its own rewards and demands. If you want an in-depth consultation on finance-related jobs, our experts at OSG can be of great help in the finance jobs hiring process. Our expert career coaches provide personalized strategies and insider guidance, so you craft standout applications, ace finance interview preparation, and build long-term career success.