According to the Graduate Outlook Survey 2025 conducted by CFA Institute, finance remains a premier career choice globally, with 37% of graduates viewing it as the most promising sector. However, anxiety is rising, with two-thirds of graduates concerned about AI impacting their prospects.

Despite these shifts, the sector offers unparalleled growth. This guide combines the latest data to prospect the finance career outlook for 2026, helping you navigate the evolving landscape of careers in finance.

Global Data Insights: The State of the Financial Sector

As we approach 2026, the global financial landscape is undergoing a significant transformation driven by macroeconomic shifts and technological disruption. For job seekers targeting the financial sector jobs market, understanding these high-level data points is crucial for positioning oneself effectively.

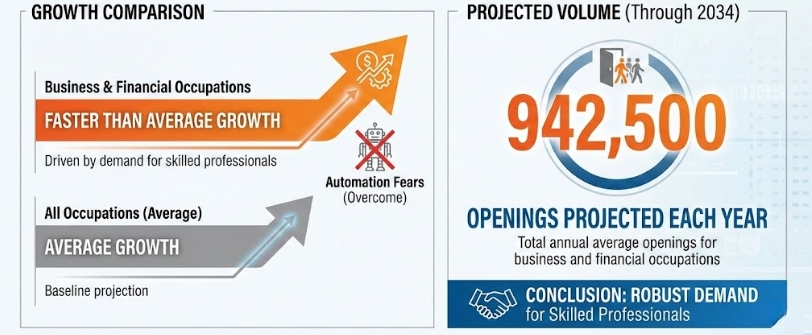

- Employment Growth Outpaces Average: Despite headlines about automation, the industry is expanding. The U.S. Bureau of Labor Statistics (BLS) projects that business and financial occupations will grow faster than the average for all occupations, with approximately 942,500 openings projected each year through 2034. This indicates a robust demand for skilled professionals.

- The Interest Rate Pivot: After a period of high interest rates that cooled deal-making, 2026 is expected to see a normalization or reduction in rates. Lower borrowing costs typically stimulate capital flow, leading to increased mergers and acquisitions (M&A) and consumer lending. This shift is poised to reignite hiring in investment banking and commercial lending sectors.

- The “AI Tax” on Operational Roles: While the outlook is positive, AI is reshaping the workforce structure. A report suggests that headcount in the financial services sector could drop by 10% to 20% over the next five years due to AI, specifically impacting operational and entry-level transactional roles. However, this contraction in back-office roles is being offset by a surge in demand for strategic and analytical positions.

- Salary Remains the Top Driver: Compensation continues to be the primary motivator for talent. In the CFA Institute survey, 58% of graduates cited salary as their top driver, followed by flexibility (49%). Fortunately, careers in finance continue to offer compensation packages significantly above the global average.

Top Finance Careers and Salary – Based on BLS Data

When evaluating types of careers in finance, it is essential to look at both current earning potential and future growth stability. The landscape is shifting from purely transactional roles to those requiring advisory and risk management capabilities.

The most resilient jobs in 2026 are those that combine financial acumen with human judgment. Roles in personal financial planning and risk management (actuarial science) are seeing double-digit growth percentages, far outstripping the general economy. Conversely, roles susceptible to automation, such as standard insurance underwriting, are facing a decline.

Popular Careers & Compensation

The following table outlines the highest-paying careers in finance and their projected growth, based on recent data.

| Occupation | 2024 Median Pay (USD) | Entry-Level Education |

| Personal Financial Advisors | $102,140 | Bachelor’s degree |

| Financial Analysts | $101,910 | Bachelor’s degree |

| Management Analysts | $101,190 | Bachelor’s degree |

| Project Management Specialists | $100,750 | Bachelor’s degree |

| Labor Relations Specialists | $93,500 | Bachelor’s degree |

| Financial Examiners | $90,400 | Bachelor’s degree |

| Budget Analysts | $87,930 | Bachelor’s degree |

| Accountants and Auditors | $81,680 | Bachelor’s degree |

| Logisticians | $80,880 | Bachelor’s degree |

| Insurance Underwriters | $79,880 | Bachelor’s degree |

| Purchasing Managers, Buyers, and Purchasing Agents | $79,830 | Bachelor’s degree |

| Compliance Officers | $78,420 | Bachelor’s degree |

| Cost Estimators | $77,070 | Bachelor’s degree |

| Compensation, Benefits, and Job Analysis Specialists | $77,020 | Bachelor’s degree |

| Market Research Analysts | $76,950 | BBachelor’s degree |

| Claims Adjusters, Appraisers, Examiners, and Investigators | $76,790 | Vary |

| Loan Officers | $74,180 | Bachelor’s degree |

| Human Resources Specialists | $72,910 | Bachelor’s degree |

| Fundraisers | $66,490 | Bachelor’s degree |

| Training and Development Specialists | $65,850 | BBachelor’s degreee |

| Property Appraisers and Assessors | $65,420 | Bachelor’s degree |

| Tax Examiners and Collectors, and Revenue Agents | $59,740 | Bachelor’s degree |

| Meeting, Convention, and Event Planners | $59,440 | Bachelor’s degree |

| Credit Counselors | $50,480 | Bachelor’s degree |

| Source: BLS, Occupational Outlook Handbook, “Business and Financial Occupations” (last modified Aug. 28, 2025). | ||

Need a Competitive Edge?

Competition for these good finance jobs is fierce. Top firms receive thousands of applications for a handful of analyst spots. To stand out from the competition, a good GPA and generic preparation are no longer enough.

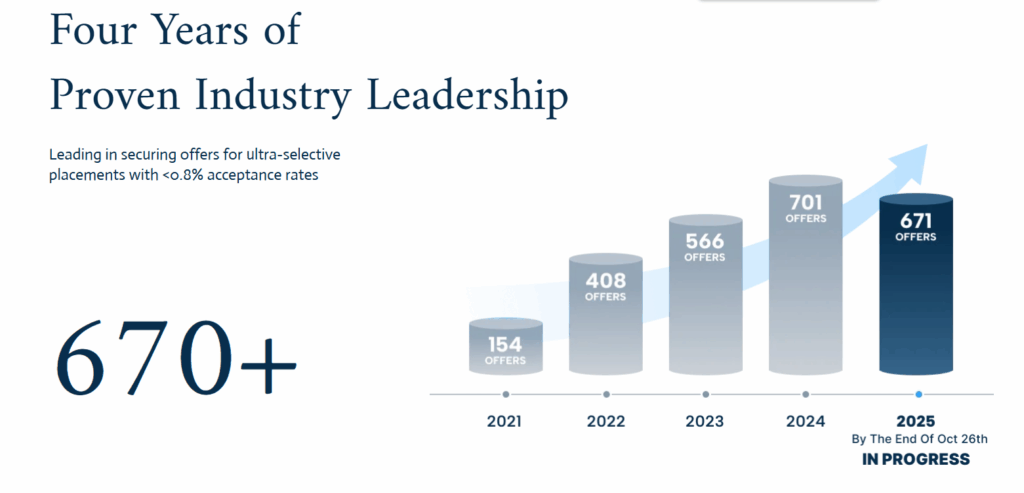

One Strategy Group (OSG) specializes in bridging the gap between talent and opportunity.

As a premier provider of career consulting services, OSG offers tailored guidance for the world’s most competitive fields, including finance, consulting, and technology. Our mentorship can help you align your profile with the high expectations of top-tier employers.

OSG Students’ Offer Performance and Achievements

What Factors Influence the Finance Industry?

Is finance a good career path for you? The answer depends on your ability to navigate the factors currently influencing the industry.

- High Salary & High Competition: The finance sector is characterized by a “high risk, high reward” dynamic. While the compensation is lucrative, the entry barrier is high. Global candidates must demonstrate distinct value—often through finance work experience gained via rigorous internships—to secure interviews.

- Regulatory Complexity: As governments tighten financial regulations, the cost of compliance increases. This influences hiring trends, creating more jobs for compliance officers and financial examiners while putting pressure on generalist roles to understand legal frameworks.

- The Education Premium: A bachelor’s degree is the bare minimum. The influence of certifications (CPA, CFA, CFP) is growing. In a saturated market, these designations serve as a proxy for competence and dedication.

- Globalization: The interconnectedness of global markets means that a financial crisis in one region impacts hiring in another. Candidates with cross-cultural fluency and language skills often have an advantage in multinational banks.

2025-2026 Trends in the Finance Sector and Employment

While the future remains uncertain, the following trends can serve as reference points for understanding potential changes in finance employment in 2025–2026:

1. Cybersecurity & Fraud Detection

As financial institutions digitize, they become prime targets for sophisticated cyberattacks, including Deepfake scams. Security is no longer just an IT issue; it is a finance issue. Firms are hiring professionals who can audit security processes and manage cyber risk.

2. Real-Time Payments

The shift toward 24/7 real-time fund transfers is changing liquidity management. Companies are upgrading systems to support instant payments, creating demand for tech-savvy treasury professionals.

3. Sustainable Finance (ESG)

Clients increasingly demand eco-friendly investment portfolios. However, there is a growing tension between the massive energy consumption of AI data centers and the industry’s sustainability goals. Professionals who can navigate this “Green vs. Tech” conflict will be highly valued.

4. Strategic Leadership Expansion

The role of the CFO is evolving into a strategic partner. 57% of financial leaders now say they are key drivers of organizational strategy, moving beyond mere cost containment.

AI and Automation: Opportunity, Not Threat

The narrative that AI will destroy careers in finance is nuanced. While it poses a threat to repetitive data entry tasks, it is a massive opportunity for analysis.

- Augmentation over Replacement: AI handles the “grunt work”—automating backend tasks like reconciliation and fraud detection (RPA). This frees up humans to focus on high-value client advisory and strategic interpretation of data.

- The Skill Shift: 40% of graduates believe AI skills will improve their employability more than traditional skills like foreign languages. In 2026, a “Financial Analyst” is expected to be part data scientist, using AI tools to uncover market insights that were previously impossible to find manually.

FAQ About Careers in Finance

1. What are the highest-paying careers in the finance industry right now?

According to the BLS, financial managers earn the most in finance, with a 2024 median salary of $161,700. Among non-managerial roles, personal financial advisors top the pay scale at $102,140.

2. What are some entry-level jobs in the finance industry?

Good entry-level finance jobs, such as financial analyst or insurance underwriter, typically require at least a relevant bachelor’s degree and some practical skills (for example, internships, Excel, and financial modeling), but they may not demand extensive work experience or multiple advanced credentials at the start.

3. Will AI replace the work of Financial Analysts?

AI will not replace the Financial Analyst, but it will replace the analyst who does not use AI. AI is excellent at processing historical data, but it lacks the nuance to manage client relationships, understand complex geopolitical context, and make ethical judgment calls. The role will shift from data gathering to data interpretation.

4. Which skills might be more important in the finance industry in 2026?

Hybrid skills are the future. Pure finance knowledge is no longer sufficient. The most sought-after candidates will combine financial literacy (accounting, valuation) with technical proficiency (Python, SQL, AI tools) and soft skills (communication, adaptability).

If you’re seeking clearer direction or stronger competitiveness in the finance job market, One Strategy Group (OSG) offers focused guidance for top finance and consulting careers.

Ready to take the next step in your finance career? Please feel free to contact us at any time.